Anyone with a dream of seeing bitcoin replacing major currencies is day dreaming ~ Sempangi Henry.

When I was a primary school pupil in the 80s, my younger sister had a pen pal from Finland. They would write to each other letters and even mail one another gifts. It took close to 4 months for a round trip letter communication between them. Upon entry into secondary school, I had friends in other schools within Uganda who I would write to and it took close to 6 weeks for a round trip communication. Had someone told me then that it would be possible to exchange messages or letters instantly without having to wait for such long periods, I would have objected vehemently. Why? Because my mind would be bloated by the status-quo.

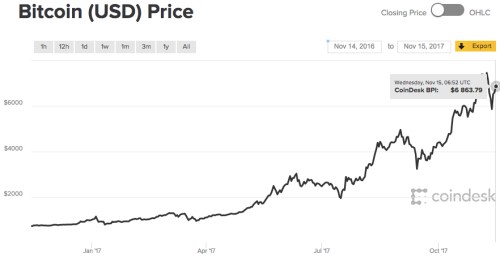

Stewart Brand said, “Once a new technology rolls over you, if you aren’t part of the steamroller, you’re part of the road.” The buzz lately is Bitcoin, the oldest and most famous cryptocurrency today. In just one month i.e between 31st October and 30th November 2017, the currency value grew by 67% and in the process crossed the US$ 10,000 mark per bitcoin.

As usual, this has caused quite a stir among the different communities of investors in Uganda. Some are calling it a scam just like D9 while others simply cant figure out what a cryptocurrency is. To a good number of people, they may be justified to rightfully treat this bitcoin thing with suspicion because;

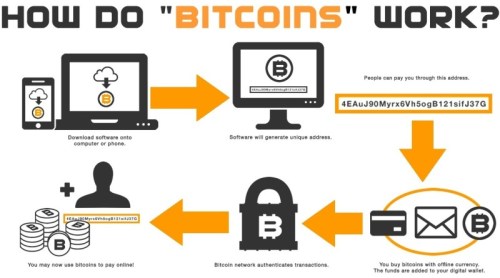

- Cryptocurrencies are abstract. Having grown up using physical money of one form or the other, many of us are having a problem embracing money we cannot see and merely have to use faith to believe in the existence of these cryptocurrencies. Matters are made worse by the low understanding of information technology by the general public.

- Who is in charge? We know that Bank of Uganda is in charge of the Uganda Shilling, Central Bank of Kenya is in charge of the Kenya Shilling etc. Who is in charge of Bitcoin? Ethereum? Litecoin? We are accustomed to amorphous bodies throwing their weight behind the currencies that we utilise and this is the same expectation being transferred to cryptocurrencies.

- How is the cryptocurrency generated? How is more money made? Traditionally, the Central bank will just order for the printing of more money as and when it deems it suitable. How do Cryptocurrencies do it? There is a process called mining that is used to generate additional currency. Its kind of like having a copper factory where each time copper is needed, all they do is to get into the ground and mine more of it. This mining for cryptocurrencies is done digitally using computers to solve complex algorithms which once successful, additional currency is added to the cryptocurrency.

- High risk. Cryptocurrencies are perceived as being highly risky. What happens if you try to log into the system and all you see is a System Fail error? Moreover if you lose your Private Key, that is the end of you. Your money is gone and can ever be recovered. This is a genuine fear but as someone who has seen banks close and account holders not get compensated, I believe a similar risk is with us even under the current approaches of financial management.

- “What is Bitcoin’s value generator?” someone asked. The Uganda Shilling currency is either physical paper or metal coins printed with a set of unique features. Bitcoins are digital mathematical tokens whose production is carefully controlled by the Bitcoin network protocol. What gives these tokens value?

-

- Scarcity. There is a limited number of bitcoins that will ever be available and the number is pegged at 21 Million. As of 29th November 2017, 16,709,550 bitcoins had been generated according to Blockchain.info. If the bitcoin is to ever be a successful store of value, then scarcity is one important attribute. Gold, Silver and Diamonds are what they are because they are scarce.

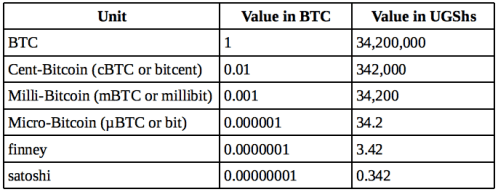

- Divisibility. Just like a Uganda Shilling can be broken down into cents, the bitcoin too can be broken down and goes a step further of being broken down to the 8th decimal place. Using the value of the bitcoin (BTC) as of 30th November 2017, the table below illustrates the breakdown. The merits of divisibility for any currency are immense.

- Easily transferrable.Bitcoin transactions take place in a matter of seconds irrespective of their source or destination. The current bank controlled transactions can take days to accomplish. This here is value.

-

- Counterfeit proof. The design of bitcoin through the use of complex cryptography to safeguard transactions rules out the possibility of counterfeits hence solving one of the biggest challenges faced by the paper/coin based money we have to deal with on a daily basis. If this is not value, then I wonder what value is.

Above all though, the value of bitcoins is gained largely from its online community that accepted them as money as far back as 2009 and also do consider the features shared above to be worth something.

Value of any currency is derived partly from the belief, trust and confidence the community has in it. By virtue of having embraced bitcoins years back, the Bitcoin community didn’t need acceptability by anyone else or backing by authorities to succeed. On the contrary, the authorities and speculators are the ones rushing to embrace bitcoins.

The downfall of the Bitcoin will most likely be a result of the same community withdrawing its confidence and support.

The hot question currently is, To invest or not in bitcoins !!!

As an observer who has taken time to understand cryptocurrencies, I have observed that bitcoin branding is being positioned majorly as a store of value. Is it a good asset (store of value)? Probably no. The fact that it appears to have a highly volatile nature makes me have less confidence in it as an asset, at least for now.

I also believe that more effort should be put in promoting transact-ability of bitcoin as this is likely to give it more value in future. Transactions are likely to grow the community and with this comes loyalty as well as its associated value.

I also believe that more effort should be put in promoting transact-ability of bitcoin as this is likely to give it more value in future. Transactions are likely to grow the community and with this comes loyalty as well as its associated value.

Being a pioneer cryptocurrency, bitcoin is charting the blue ocean (uncharted waters) of digital finances. It’s bound to make numerous mistakes that could prove fatal to its very survival but one thing we can’t deny is that we are all learning daily from its journey.

So, you still want to buy bitcoins? I say, they are over priced currently. If you really have to, invest sums of money that will not hurt you much when this cryptocurrency implodes. Remember, buying the bitcoins is one thing, however, selling them is another. Information from those that are actively investing in them reveals that offloading bitcoins isn’t as smooth as they would want it to be.

James Wire is a Small Business and Technology Consultant based in Kampala, Uganda

Follow @wirejames on Twitter.

Email lunghabo [at] gmail [dot] com