Every end of year heralds the start of a new year. Failures and achievements of the past year give rise to optimism for the new year. One characteristic of agile human beings is having hope in the future.

Some of you have full time jobs and are considering setting up a side business while others are unemployed but are looking at setting up a business in order to earn a living. Whatever the reasons for aspiring to start a business this year, below are ten tips to get you going;

-

Identify the right business for you. There are numerous business opportunities ready for exploitation. However, it is always crucial to settle for those that gel well with your abilities and lifestyle. As a teetotaler, the last business I can invest in is a bar however much it promises high returns. If you are an employee with an 8 am to 5 pm job, a business that operates in the evening hours would be ideal for you. An individual with roots from Gulu or Lira districts is most likely well positioned to trade in SimSim, Sunflower or honey.

-

Draft a business plan. Talk of a business plan sends shudders down the spines of many. This fear has been brought up by the amorphous business plan documents that we have chanced across. Consider this plan as a guide for your business idea. You can make it as simple as possible afterall it has to be in a manner that you easily understand. You can write a business plan of two pages and it works for you, for starters at least.

-

Drop the procrastination. Defined as the act of continuously delaying something that must be done, procrastination is one of the biggest vision killers. Each time you have desired to get the ball rolling, somehow you get a convenient excuse not to proceed. If you are to realise your dream this year, steer clear of procrastination.

-

Start now. You know the kind of business you want to do, you have a plan in place and have abandoned procrastination, the next step is to START!!! Yes. Kick off your activity to realise your business dream. Do not wait till you have furnished an elegant office and hired high end professionals. Just get started, today.

-

Start small. Most businesses that are self funded hardly have the luxury of so much money at their disposal. With your limited budget, focus on starting small and grow organically. You dont have to try and emulate other players in the business that are already runaway successes. The other beauty about this approach is that even when you make a mistake, the kind of resources lost are limited to a manageable tune.

-

Optimism is important, but …. Doing business requires a good dose of faith. This is what we regularly refer to as optimism. However, as we raise our faith, we shouldnt forget to prepare ourselves too for the worst. There are times when circumstances conspire and lead an otherwise promising business to the gutters. Think about that too as you walk your journey.

-

Brand appropriately. Branding is the activity of connecting a product or service with a particular name, symbol etc or with particular features or ideas in order to make people recognise and want to pay for it. You might have started small but that shouldn’t stop you from branding yourself the way you want the market to perceive you. Remember, when you eventually hit the big time, its this very brand that you will have relied upon. So, it had better be a brand you want to portray.

-

Take on manageable opportunities. By now, you’ve started operating your business and some deals are coming through. Bite what you can chew. Try as much as possible to manage the kind of business you undertake. Like a child, you’re probably still at that stage in life where you’re just learning how to walk and its too early to try out running. A young man who had just started a company dealing in produce was tempted to pursue an opportunity supplying the Uganda Police with grains. After borrowing money, he was able to supply as required only for him to wait another two years before being paid. Do not ask me what he went through with the money lenders.

-

Let mistakes encourage you. You’ll make mistakes as you run the business. The most important thing though is to avoid being discouraged and looking at your self as a failure. Seek encouragement from the mistakes. Remember, failure usually gives us our biggest lessons. How often do you sit back to learn from an experience where you were wildly successful?

-

The big break takes time. The glamour that comes with being a successful icon in business is loved by many. Unfortunately, we usually never get to hear about the trials and temptations those being recognised go through on their journey to the top. For you to achieve your vision, be ready to slug it out through thick and thin. There will be many lows interrupted by a few highs, but all you need to do is maintain the zeal. Your break into the big time could take a year or even ten years. It all depends upon numerous factors.

By now you should be in a better position to get yourself in order for the task ahead. These are just a few tips that can hopefully help you set the ball rolling.

James Wire is a Small Business and Technology Consultant

Blog: wirejames.com

Twitter: @wirejames

Email: lunghabo (at) gmail (dot) com

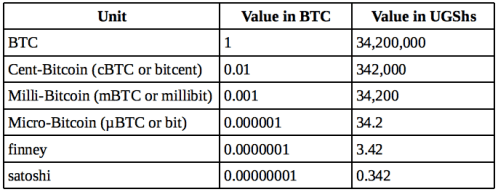

I also believe that more effort should be put in promoting transact-ability of bitcoin as this is likely to give it more value in future. Transactions are likely to grow the community and with this comes loyalty as well as its associated value.

I also believe that more effort should be put in promoting transact-ability of bitcoin as this is likely to give it more value in future. Transactions are likely to grow the community and with this comes loyalty as well as its associated value.