Nationalism is one thing that is hard to maintain in Uganda. I love everything about Uganda’s resource endowment but the various efforts being put into stunting our potential to exploit these resources irks me so much.

You might have already heard about the move by the Ministry of Trade, Industry and Cooperatives to grant a license to Ms Gotovate Uganda Ltd to import upto 50,000 tonnes of rice tax free from Tanzania.

One wonders why the Government deems it fit to make such a move at this point in time. For those not in the know, Uganda’s rice industry has been growing in leaps and bounds thanks to initiatives aimed at promoting upland rice as well as research into new high yielding varieties.

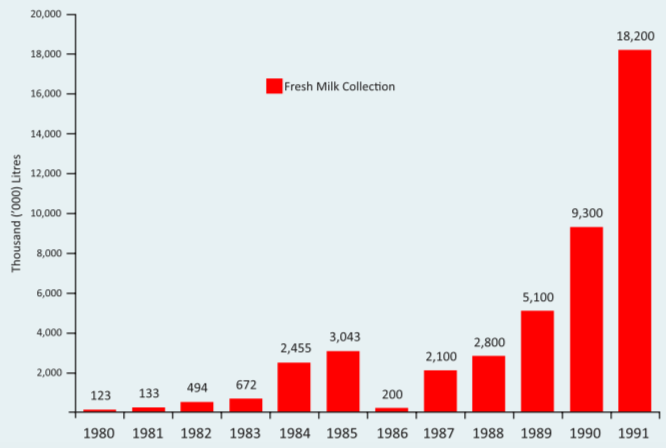

Production is rising as various regions of the country take up rice farming. Rice is to farmers in other regions of the country what Milk is to Western Uganda. Alot of support was extended to the diary industry and it’s no surprise that today the country is a leading milk producer on the African continent. We can achieve the same with rice and improve massively on the household incomes across the board.

By choosing to import rice, it simply means that the authorities aren’t interested in seeing rice farmers get decent income from their efforts. This whole move is shrouded in mystery as reported by The Daily Monitor.

Without mincing words, this is a well crafted plot by fly by night speculators whose overall aim is to make money irrespective of the harm they bring upon the populace. They tend to collude with gluttonous officials that have made it in life through being crooks.

The promises made by the government to improve people’s incomes as well as retaining money in the economy make such moves defeatist. If these belching crude officials were to exchange roles with the rice farmers, they would perhaps appreciate the pain that we are going through now.

Honourable Amelia Kyambadde the Minister of Trade is one person that is known for occasionally doing the right thing at least but a couple of questionable decisions she has made in the past have soiled her reputation among local business people. Take a look at how she handled the Uchumi and Nakumatt supermarket closures and you’ll wonder whether her team has a genuine commitment to Buy Uganda Build Uganda.

For too long, various so called planners have always accused Ugandans of not being able to effectively harness the opportunities before them. However, how shall we be expected to get the best of the opportunities when every time our initiatives are sprouting, executive decisions deliberately cripple them?

I think it is high time we realised that there are people out there in the corridors of power that dislike seeing the local Ugandan get rich. By opening up tax free imports of rice for a few regime royals, the small holder rice farmer is being intentionally suffocated.

It is my prayer that someone prevails upon the officials responsible for this decision. Ugandans have a right to be protected economically.

James Wire

Business Consultant & Farmer

@wirejames on Twitter