For those that are digitally alert, no day passes without you hearing about Bitcoin, Onecoin, Litecoin, Ethereum, Ripple among others. This is a follow up article on an earlier one I wrote introducing blockchain and cryptocurrencies. It is helpful to first understand blockchain before diving into the world of cryptocurrencies.

What is a cryptocurrency? This is a digital currency that uses cryptography for security.

Digitally, cryptography involves creating written or generated software codes that allow information to be kept secret. It converts data into a form that is unreadable for an unauthorised user, thereby enabling it to be transmitted without fear of an unintended recipient understanding it hence enhancing its integrity.

What is a currency:

-

A Medium of exchange – It is a more efficient way of exchanging products and services as opposed to barter trade.

-

A Store of value – A mechanism by which wealth can be saved and retrieved in the future with some predictability e.g gold, silver, reserve currencies, stocks, bonds etc.

-

A Unit of account – A standard measurement of the value of goods, services, assets and other economic activities e.g. the value of a soda versus ten passion fruits.

A journey through history shows that we have traversed from barter trade all the way to the current paper money as depicted in this image.

Digital money has been making its mark over the past few decades. As opposed to cryptocurrency, digital money is defined as any means of payment that exists purely in electronic form. Mobile Money would be an ideal candidate in this regard. The reason it can’t be called cryptocurrency is the absence of cryptography.

Cryptocurrencies can be characterised by some or all of the following attributes;

-

Entirely virtual currency created by computer code.

-

Rely on the use of cryptography to effect highly secure transactions as well as the creation of new units of the currency.

-

Rely on a publicly available ledger to keep a record of transactions undertaken.

-

Use a wallet (defined later) to facilitate transactions.

-

They are highly decentralised in nature of operation as a result of most of them depending on the blockchain technology (this was covered in the previous article).

-

Due to the dependence on blockchain by most cryptocurrencies, transactions aren’t easily reversed once approved.

-

User identities are protected. The public ledger maintained never bears any detail that can uniquely identify a user.

Traditional monetary systems entail Governments issuing money which is then controlled by a Central bank eventually getting to the users through the commercial banks. This implies that there is heavy control by the issuing authority of the currency.

Enter cryptocurrencies, unlike the traditional monetary systems, they are fully decentralised with no central government control. Think about it as community generated currency though this time in a digital format. Money is what it is because people agree to it as a medium of exchange. Hence, any community of people that come together and agree to create their own currency and trade in it can validly create a currency.

Enter Bitcoin

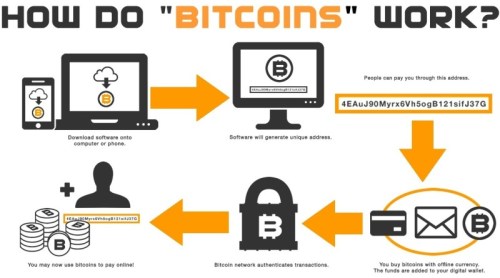

Bitcoin is a cryptocurrency that uses decentralised technology for secure payments and storing money that doesn’t require banks or people’s names.

It was the first cryptocurrency to be formed in 2009 and has since gone on to be the most widely used or preferred. It has no government backing, no delays when sending money as well as minimal transaction fees if any (due to the elimination of the numerous third parties).

Some terminologies to be familiar with before we proceed are:

-

BTC: A common unit used to describe one bitcoin, just like one US Dollar.

-

Bit: There are 1,000,000 bits per bitcoin, 1 bit = 0.000001 BTC.

-

Bitcoin Wallet: This is where you store your bitcoins. It is a program that manages your bitcoin addresses and allows you to transact. In otherwords, it is a collection of addresses and the keys that unlock the funds within.

-

Bitcoin Address: Is also regarded as the public key, it is like an email address. You issue this to anyone you expect to receive payment from. Always advisable to create a new one for each transaction. You are at liberty to have as many as possible.

-

Private key: Every public key has a private key associated with it. It is a secret piece of data that proves your right to spend bitcoins from your wallet. Kind of like a password.

-

Bitcoin Client: Is the software application or web service managing your wallet and addresses. It connects a user to the Bitcoin network.

Ownership of bitcoins is established through digital keys and signatures. The keys are generated locally using the Bitcoin Client then stored in a bitcoin wallet. These keys then allow the user to sign transactions thereby providing proof of ownership of the traded bitcoins.

Be very careful who generates your private keys and where they are stored. Read more on Bitcoin security !!!!!

Types of Bitcoin Clients

-

Full Client: This is a client that stores the entire history of bitcoin transactions, manages the user’s wallets and can initiate transactions directly on the Bitcoin network. It never communicates the private keys and stores them locally.

-

Web Client: Is accessed through a web browser (kind of like Gmail) and stores the user’s wallet on a wallet owned by a third party server. It relies entirely on third party servers.

-

Lightweight Client: It stores the user’s wallet but relies on third party owned servers for access to bitcoin transactions and the network. Just like a full client, it stores the private keys locally.

-

Mobile Client: Largely used on smart phones, it can operate as a full client, lightweight client or web client. Some mobile clients can be synchronised with a web or desktop client, providing a multi-platform wallet across multiple devices, with a common source of funds.

We noted earlier that the “Keys” are very crucial towards the security of your bitcoins. How you store them is determined a lot by your choice of Bitcoin wallet and client.

Local Storage – If you have a good computer and take steps to avoid intrusion or exposure, this option is fine. However, if your computer is hacked into, crashes and you have no backups, or you forget your passwords, then most likely your private keys and bitcoins will be lost forever. You trade off convenience for security in this case.

Remote Storage – Reliance is on a third party. If their security is compromised or they act maliciously, your bitcoins are lost forever. Third party exchanges are more likely targets for intruders, when compromised, you are likely to lose your bitcoins for good. The biggest offer here is exchanging security for convenience.

Feel like getting started with Bitcoin? Get more details here.

Bitcoin’s value is increasing in leaps and bounds by the day, the cryptocurrency is gaining lot of credibility in mainstream financial circles. From Europe to Asia and the Americas, restaurants and various businesses are embracing bitcoins as a form of payment. By October 2016, there were 1,587 Bitcoin ATMs worldwide. Virgin Galactic, a Space Tourism company accepts bitcoin payments from customers. The University of Nicosia in Cyprus was the first ever such institution to accept school fees payments in bitcoins.

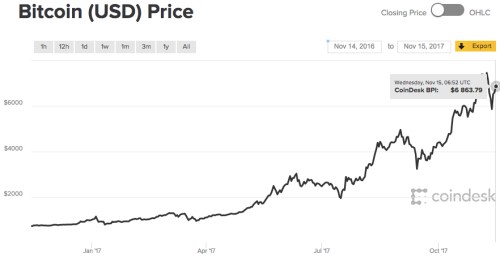

Over the past one year i.e. November 2016 to November 2017, the price of a bitcoin has early increased tenfold. From US$ 706 on the 14th of November 2016 to US$ 6,863 as of the 15th of November 2017.

Bitcoin price growth over a one year period

If you want to familiarise yourself more with cryptocurrency trading, set up an account. I used Coinbase to set up mine and it gives me rates in Uganda Shillings equivalent for Bitcoin, Ethereum and Litecoin. All these are different cryptocurrencies one can trade in. The snapshot below shows that within a span of one month, the price of one bitcoin currently at UGX 25,069,624 increased by 22% reflecting a net gain of UGX 4,540,169.

A typical Coinbase account

You may be scared by the cost of a bitcoin being at UGX 25 Million. That shouldn’t bother you so much. You don’t have to buy an entire bitcoin to trade. Remember as earlier noted, a bitcoin is divisible into 1 million bits. This literally means that at the going rate, 1 bit costs UGX 25. So, with UGX 100,000 you could literally buy 4000 bits which is the equivalent of 0.004 bitcoins (BTC).

[Begin Update]

After getting feedback from readers about Coinbase not supporting operations in Uganda, I did some further research and came across SpectroCoin . According to the website, they have support for cryptocurrency trading in Uganda complete with Mobile Money integration allowing you to purchase as low as UGX 500/. This is not an endorsement of their service but like any other venture, I advise you to tread very carefully to avoid making mistakes.

[End Update]

The world is entering a phase of cryptocurrencies, much as there might be a lot of doubt cast upon this trend, the reality is that it’s a matter of time before they too gain credibility just like any other innovations that were derided in the past. Should you be considering them as a form of investment? That is another question that shall be addressed separately.

I hope this has been helpful. Feel free to ask questions in the comments section.

James Wire is a Small Business and Technology Consultant based in Kampala, Uganda

Follow @wirejames on Twitter.

Email lunghabo [at] gmail [dot] com

Other Articles:

Simplifying Blockchain and cryptocurrencies for a Ugandan

Other Sources:

-

http://www.ironlotuspt.com/images/content/bitcoin-work-1.jpg

-

https://coinlist.me/wp-content/uploads/2016/12/how-does-bitcoin-work.jpg

-

University of Nicosia, Msc in Digital Currency notes.