In 1974, somewhere in Parys, Free State, South Africa, a baby was born and named James Seipei Stompie Moeketsi. He was born at a time when the fight for black liberation in South Africa had gained steam. The likes of Nelson Mandela had been imprisoned as his wife Winnie Mandela continued with the struggle on the outside.

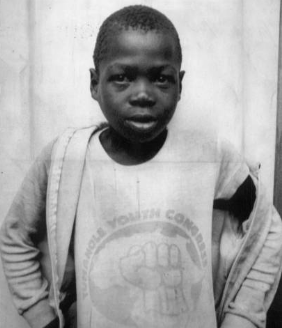

James Seipei Stompie Moeketsi – Photo, Huffingtonpost.co.za

Growing up in a wretched environment strategically designed by the apartheid perpetrators to dehumanise and disempower the black South African, the young boy gained a sense of purpose at an early age in life. Unlike today’s urban dwelling child who spends time just watching cartoons, playing their X-Box or hanging out in exotic play areas, Stompie realised at an early age that he had to be part of the solution to the disempowerment of black South Africa.

By the time he clocked ten years, he had joined the active anti-apartheid uprisings and went on to make a record of being the youngest political detainee at 12 years. This is the age when today’s child is still considered a baby and is pampered like the world will end if they do not get what they asked for. The zeal of teenagers and youths when it comes to some of these matters has a tendency to cross acceptable limits. They usually believe in the ideas thrown at them 150% potentially creating radicals out of them.

Stompie was that guy who made it a life time call to achieve freedom for the black South African. Like fate would have it, on December 28th 1988, he and three other boys were kidnapped only to be murdered on 1st January 1989. At the age of 14 years, this young energetic, zealous beacon of hope for Black South Africa had his life terminated by a one Jerry Richardson who was a member of the infamous Mandela Football Club.

The death of Stompie sent reverberations throughout South Africa with the liberation struggle proponents questioning each other on Who did or didn’t do it!

Little did they know that thousands of miles up north of South Africa, a young man, born in 1974 like James Seipei had grown so fond of the liberation struggle. His interaction with South African students who were studying in exile had given him a taste and feel of what was going wrong that side of the continent. He was lucky to be in school studying at a time when Stompie had dropped out in preference for pursuing the struggle.

The death of Stompie jolted this young man out of his sleep and after a period of grief, he decided to take on the names Stompie Seipei Moeketsi in memory of the late. This young man begun referring to himself as James Wire Stompie Seipei Moeketsi. Later, his school mates broke it down and while some called him Stompie Seipei, others referred to him as Moeketsi. Eventually, the name Stompie became synonymous with James Wire.

Alot is said about who killed or didn’t kill Stompie and one may be wondering why I chose to honor Stompie today. Once again, as I write this, thousands of miles south of Uganda, in Orlando Stadium, Soweto, Johannesburgh, the late Winnie Madikizela Mandela is being honored for her role in the struggle for Black South Africa emancipation. She was behind the notorious Mandela Football Club and the death of Stompie is attributed to her by many. However, it is not my role to condemn or exonerate her. All I can say is that she is closely tied to the circumstances that led to the demise of James Seipei.

Winnie Mandela, being in a struggle might have made some mistakes and for those who do not know, a struggle isnt a walk in the park. All parties involved tend to slip up here and there. This however doesn’t negate the very positive contribution this lady made to the struggle. She kept the candle burning while her husband was incarcerated. Many other incarcerated liberators had wives too but how many came up to keep their husbands’ ideals alive?

For all she did, I thank God that she was able to see South Africa come out of the apartheid era. As for James Seipei, it is a pity that he ended up being collateral damage in a game that involved very calculative and sophisticated tormentors backed by the oppressive apartheid regime.

In 2013, I paid a visit to South Africa and this time round had a deep conviction to find out more about how the blacks lived. It therefore came as no surprise when I walked out of my hotel in the plush Rosebank suburb with the intention of spending an entire day in the impoverished suburb of Alexander. My guide happened to be a resident of Alexander and he didn’t disappoint.

The home I visited in Alexander, South Africa.

What I saw there made me question whether what James Seipei Stompie Moeketsi died for had been achieved. The levels of poverty are unimaginable. The kind of housing for people who dwell in an environment where temperatures swing from as low as 5º C upto 30º C was very questionable. I entered an excuse of a home that was basically thin flimsy iron sheets nailed on poles to form a wall with others covering the top acting as a roof. This 4m X 5m size shack was home to a family of five. Three children of whom two were already teens aged above 13 years staying with their two parents. I could only see one bed in the house, a corner reserved for cooking and another that had multiple uses among which was that of being a bathroom at the appropriate time. Privacy was non existent in that home, food was just enough for the next meal, so much was not right but what could they do about it after being abandoned by their liberators that chose to join the looting elite?

With a sorrowful heart, I vividly recall this sad experience as well as many others while in Alexander and wonder really whether Sompie Seipei is happy for the ultimate sacrifice he made for his country.

RIP Stompie Seipei Moeketsi

God Bless South Africa.

James Wire