Resilience is defined as the ability of people, organisations, systems to mitigate, adapt to as well as recover from shocks and stresses. If there is a bank in Uganda that has shown its resilience in the recent past, then it is DFCU Bank.

Following the takeover of another local bank, the storms that the institution has had to wade through have not been easy. This was very evident in the media presentation of the bank’s performance over the year of 2018.

Some quick facts about the bank:

• With 65 branches across the country, it is the 2nd largest branch network.

• Over 420 ATMs access

• Over 600 Agent Bankers across the country

• Customer base of over 1 Million depositors

• Mobile banking App

Operating in a seemingly stagnant economy, the bank was able to show flashes of marginal improvement in a number of areas and this should be a cause for some celebration. It is a pity that always the profit registered is what most consider when rating the health status of a business. This should always be done in context though.

The role DFCU bank plays in promoting Small and Medium Enterprises is quite impressive. Through the creation of opportunities for the SMEs in the form of training as well as investment support, the bank has impacted on a section of the business community that is crucial to the local economy.

All through the presentations, I strongly noted the following as the key take home issues from the bank’s performance;

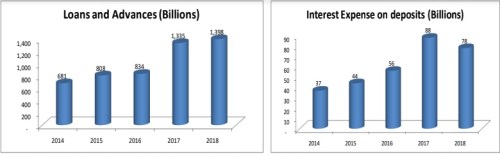

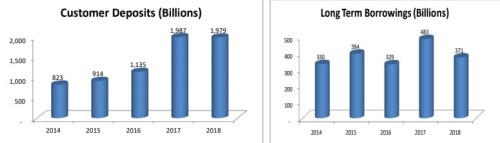

• There was a significant drop in reliance on third party borrowings

• The lower interest cost is a great sign of improved operational efficiency

• There was a remarkable growth in the income from other sources other than interest income.

• Improvement in the portfolio quality resulting in a lower impairment charge.

Harbouring ambitions of being a market leader and technology driven financial institution, the journey has only just begun.

With a new MD in place, Mr. Mathias Katamba, I can only look at the future with more hope considering that DFCU bank is an indigenous bank that is rolling with the big global names in the market place.

James Wire is a Business and Technology consultant based in Kampala, Uganda

Twitter – @wirejames